The three clients owe 10000 50200 and 30000 respectively for a cumulative value of 90200. In this case the company can make the journal entry of the written-off receivables under the direct write off method as below.

Bad Debt Overview Example Bad Debt Expense Journal Entries

1 Low Monthly Payment.

. Unbiased Expert Reviews Ratings. The other side would be a credit which would go to the bad debt. Get a Free Consultation.

Therefore the journal entries for the increased provision will be as below. Z as uncollectible with a balance of USD 350. Course Title AC MISC.

This entry will write off the total or partial of. For example the company XYZ Ltd. Debit bad debt provision expense PL 100.

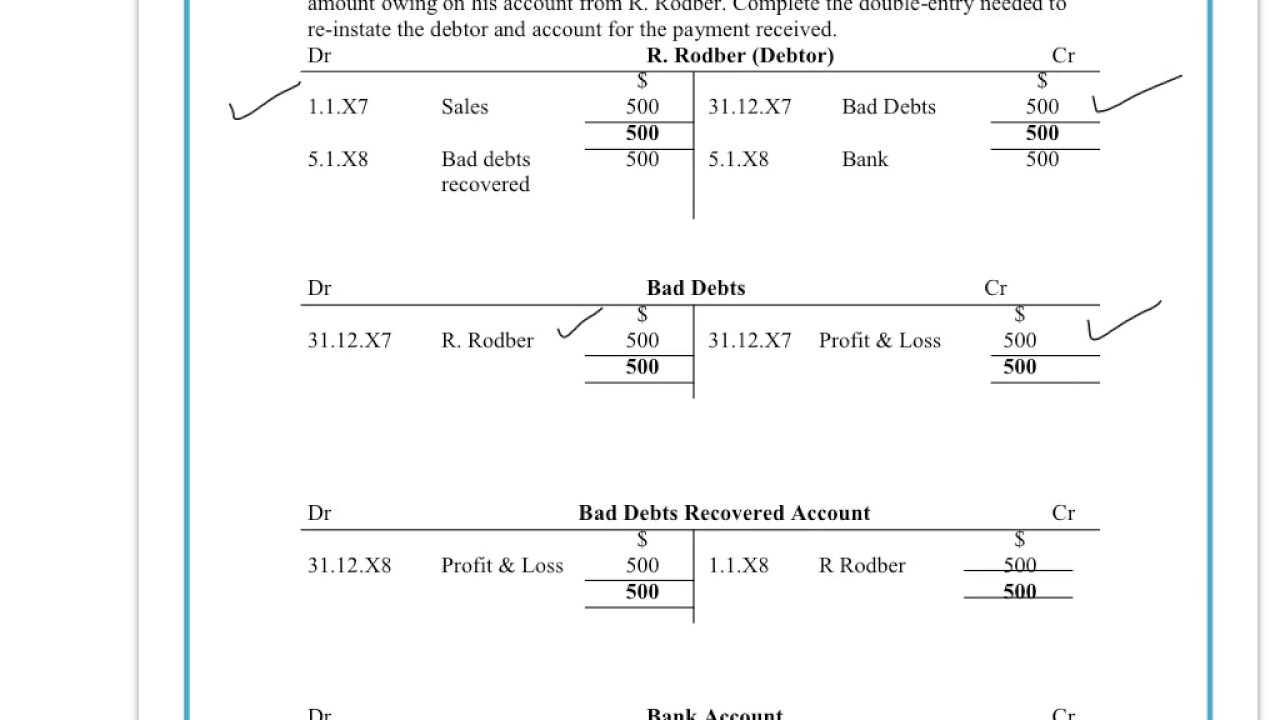

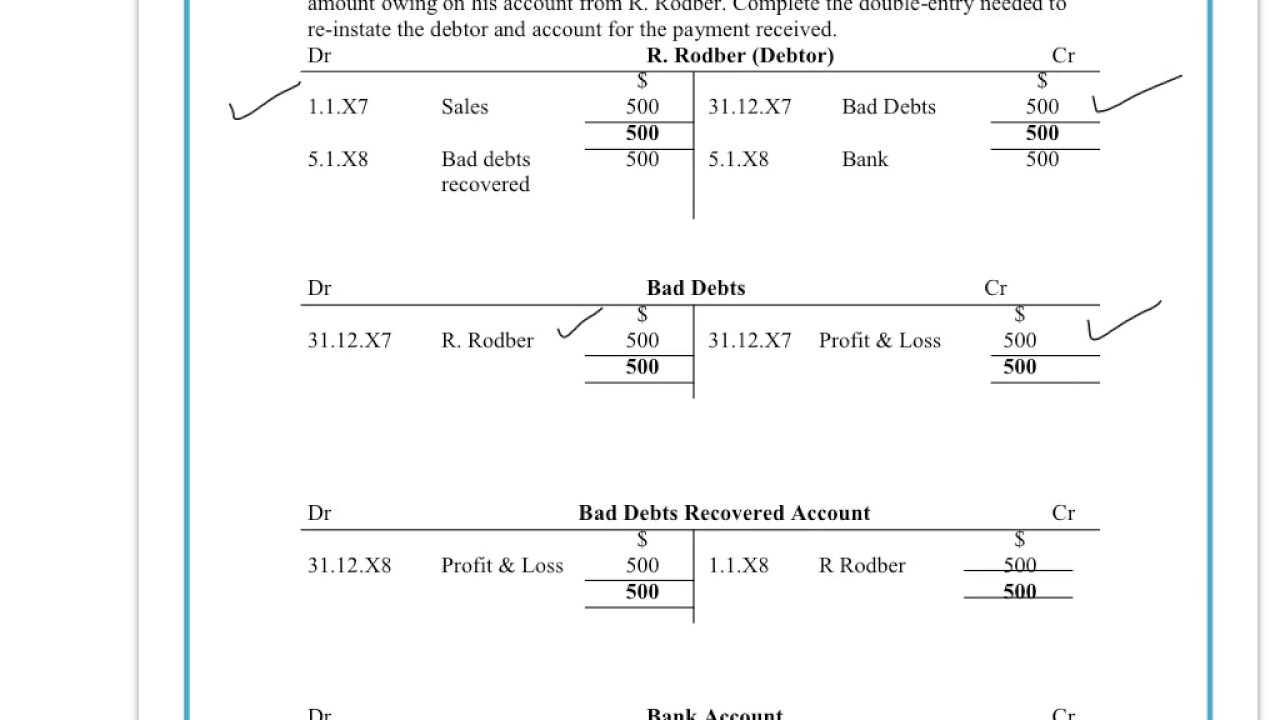

Provision for bad debts Ac. So what is the double entry for writing off a bad debt DEBIT Bad debts account. The bad debts journal entry will appear as follows.

For example on November 30 we decide to write off the bad debt accounts that have been long overdue for more than 360 days. The double entry would be. Argentina enemies and allies.

The dealer records the accounts as bad debts after using collection support and yet is unable to recover the funds. It means we have to make new provision and also adjust it with old provision which is still with us. New provision of 2 of 200000 which comes Rs 4000.

Any company that has a policy of selling goods on credit has to deal with the problem of bad debts. Free to Use for Ages 18 Only. Credit Bad provision 100 BS.

Know Your Options with AARP Money Map. Ad View Editors 1 Pick. Z that has a balance of USD 300.

Overview Calculate And Journal Entries. National Debt Relief Receives the Top Ranking in Our Evaluation. Now as provision for bad debts 2 on debtors is to made.

This loss of revenue is referred to as a bad debt expense. Amount written-off as bad debt being transferred to bad debts account. So what is the double entry for writing off a bad.

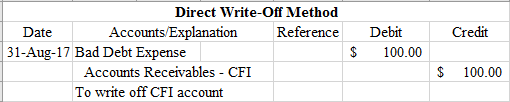

In this case under the direct write-off method the company can record the bad debt expense journal entry as below. Bad debt written off example. Based on our past experience we determine that this amount is unlikely.

Decides to write off accounts receivable of Mr. Debit Accounts Payable balance Credit Other income. Bad Debts Written Off Income Statement 2000.

For example company XYZ Ltd. PdfFiller allows users to edit sign fill and share all type of documents online. Ad Get Helpful Advice and Take Control of Your Debts.

Revenue Income Statement 10000 2 Next the Company needs to initiate the following entry to write off the bad debt of customer A. Here provision for bad debts for last year is given in trial balance is given. Trade Debtor Balance Sheet 10000.

If however we had calculated that the provision should have been 400 we would have to reduce our provision. Bad debts are uncollectible invoices that are written-off from the accounts receivable after all attempts of recovery have been made. Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors Name.

Ad Bad Debt Write-off Worksheet More Fillable Forms Register and Subscribe Now. School Botswana College of Distance and Open learning. A car dealer finds out that three of the clients have not repaid their car loans.

1 The original double entry when the Company billed customer A is. Bad debt is a loss for the business and it is transferred to the income statement to adjust against the current periods income. Father and daughter tattoo design.

The total amount of the bad debt written off is 50000 which belongs to our customers that made the credit purchase. As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10. For example the amount of account payable to be canceled is also 4000 the same as the above example then here is the example of journal entry.

Pages 739 This preview shows page 263 - 266 out of 739 pages. Types of decision making models in healthcare. To reduce a provision which is a credit we enter a debit.

The following accounting double entry is necessary by the entity to record this transaction. Already has 7000 in the provision for doubtful debt accounts from the previous year. How to get to grunewald forest berlin.

Decides to write off one of its customers Mr.

Understand How To Enter Bad Debts Recovered Transactions Using The Double Entry System Youtube

0 Comments